Why Income statement vs balance sheet are important in business?

What is Income statement and balance sheet

The big question: what is an income statement and balance sheet?

Basically, a balance sheet is a financial report that shows what a business owns (assets), what it owes (liabilities), and how much the business actually owns (equity) at a specific point in time. It's like taking a snapshot of the company's financial health at that particular moment.

On the other hand, an income statement gives an overview of a business's financial performance over a certain period of time, usually a year or a quarter. It shows the company's revenue, expenses, and net profit or loss during that period.

Although both are used to monitor a business's finances and make appropriate spending and investing decisions, there are key differences between the two. While a balance sheet provides a snapshot of a company's financial position at a specific moment, an income statement gives an idea of how the company is doing financially over a period of time. Both are important financial statements that can give investors, creditors, and other interested parties an idea of a business's financial health and stability.

Income statement vs balance sheet are both important financial statements

Why is it impportant?

Using both statements together can offer much insight into the operations and finances of running a business. Analyzing the biggest liabilities on a balance sheet and major losses on an income statement can help identify ways to cut losses or reduce liabilities. Meanwhile, focusing on profits on an income statement and the most valuable assets on a balance sheet can help identify ways to leverage assets to profit even more.

It's essential to notice red flags early on, such as a rising liability-to-assets ratio, recurring losses, and frequent accounting errors, to minimize losses and pivot toward profit. Investors and lenders may also use financial statements, such as a balance sheet and income statement, to make future spending decisions. Therefore, it's crucial to use both statements to get a complete picture of the organization's finances.

Using both statements together can offer much insight into the operations and finances

Learn more about: Accordant sample of income statement and balance sheet 2023

So, what are the key differences between these two financial reports?

Timing

Timing plays an essential role in financial statements. While the balance sheet provides a snapshot of a company's financial standing at a particular time, an income statement reveals the financial results for a given duration. For instance, a balance sheet as of December 31st will be reported alongside an income statement for the entire month of December.

Timing plays an essential role in financial statements

Items reported

Regarding items reported, a balance sheet details a company's assets, liabilities, and equity, while an income statement highlights revenue and expenses that ultimately determine whether the firm made a profit or incurred a loss. Additionally, the income statement indicates tax expenses, whereas unpaid tax liabilities are recorded on the balance sheet.

Metrics

Metrics derived from financial statements differ, and they serve different purposes. The balance sheet's line items are used to determine a company's liquidity, while the subtotals in the income statement are compared to sales to obtain gross margin percentage, operating income percentage, and net income percentage.

Uses management

When it comes to uses, the management team utilizes the balance sheet to gauge if the business has sufficient liquidity to meet its obligations, whereas the income statement is employed to detect any operational or finance issues in need of correction.

Uses - creditors and lenders

On the other hand, creditors and lenders utilize the balance sheet to determine if a company is over-leveraged, which informs their decision on whether to extend additional credit to the entity. Additionally, they use the income statement to assess if a business is generating enough profits to pay off its liabilities.

Important

While the significance of financial statements varies from reader to reader, generally, the income statement is considered more important than the balance sheet since it reports a company's results. However, a lender might prefer to analyze the balance sheet as it provides insight into the liquidity of a loan applicant.

The income statement is considered more important than the balance sheet

Using Both Statements to Assess and Improve Your Business

Using a balance sheet and an income statement together can offer much insight into the operations and finances of running your business.

To assess and improve your business, you need to look out for key things: losses and liabilities, profits and assets, and red flags.

Losses and liabilities

When analyzing your balance sheet, look at the biggest liabilities; when analyzing your income statement, focus on the major losses. What’s draining the most money? What are some ways you can cut your losses or reduce the liabilities?

Profits and assets

Focus on the profits on your income statement and the most valuable assets on your balance sheet. Take the opposite approach of what you did in the previous section. Now, analyze what’s making you the most money. What are some ways you can leverage your assets to profit even more?

Red Flag

Noticing the red flags in your financial documents early on can help minimize your losses and pivot toward profit before it’s too late. Common red flags to look out for include rising liability-to-assets ratio, recurring losses, and frequent accounting errors (miscalculations, etc.).

Improve your business with both reports

Apply software to support with balance sheet vs income statement

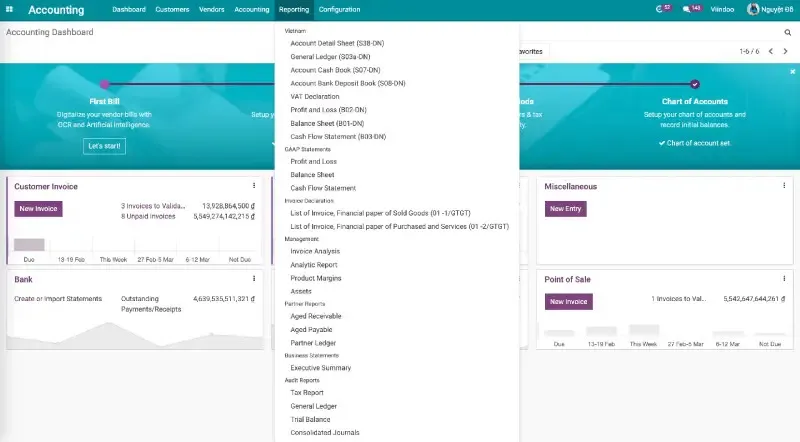

Financial accounting software can be a useful tool for generating income statements and balance sheets, as well as for analyzing and interpreting financial data.

Similarly, to generate a balance sheet, accounting software typically requires users to input data related to a company's assets, liabilities, and equity at a specific point in time. The software then calculates important metrics such as the company's current ratio, which is a measure of its liquidity.

Once generated, accounting software can also be used to analyze and interpret the data presented in both the income statement and balance sheet. For example, software may offer visualizations such as graphs or charts to help users identify trends or anomalies in the financial data. It may also provide functionality for comparing financial data across different time periods or for different business units within a company.

Overall, the application of accounting software to support income statement and balance sheet preparation and analysis can streamline the process of financial reporting and help businesses make better-informed financial decisions.

Viindoo accounting software supports income statement vs balance sheet preparation and analysis

Replies to This Discussion