What are retained earnings?

The concept of retained earnings

What is retained earnings concept? Retained earnings are the cumulative amount of a company's earnings that have not been paid out as dividends to shareholders. Retained earnings can be classified as either revenue reserves or capital reserves, depending on the source of the earnings.

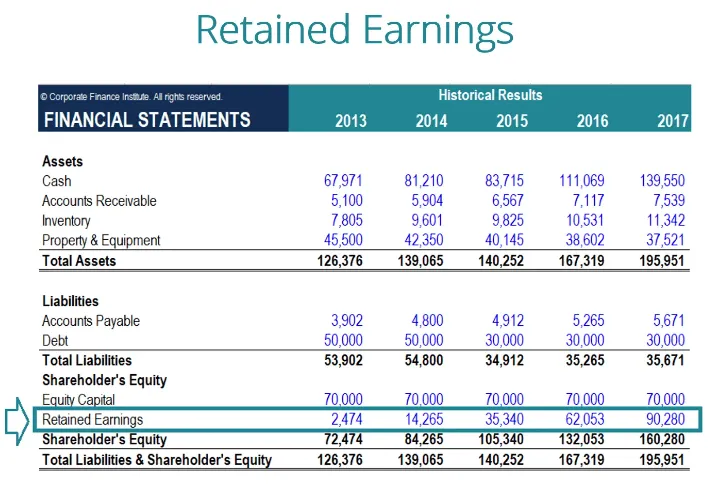

Retained earnings on balance sheet

Where do retained earnings go on a balance sheet? Retained earnings go on the balance sheet under the shareholder's equity section, which is also known as the statement of shareholders' equity. This section includes the company's capital stock, additional paid-in capital, retained earnings, and other comprehensive income.

What are retained earnings on a balance sheet?

How to calculate retained earnings on balance sheet

Retained earnings can be calculated by subtracting the dividends paid to shareholders from the net income earned by the company. The formula for retained earnings on balance sheet is:

Retained Earnings = Net Income - Dividends Paid

Where "Net Income" is the total revenue earned by the company minus all expenses incurred during a specific period, such as a quarter or a year. "Dividends Paid" refers to the portion of net income that is paid out to shareholders as dividends.

For example, if a company has a net income of $500,000 and pays out $50,000 in dividends to shareholders, the retained earnings in balance sheet would be:

Retained Earnings = $500,000 - $50,000 = $450,000

Therefore, the company would have $450,000 in retained earnings that it could reinvest back into the business for growth and development.

How do you calculate retained earnings on a balance sheet?

What is retained earnings' affection?

Importance of retained earnings

Retained earnings are critical for a company's long-term success. By reinvesting earnings back into the business, companies can fund new projects, expand operations, and improve profitability. Retained earnings also serve as a cushion during tough economic times when revenue streams may be unpredictable or unstable. Companies with strong retained earnings are better positioned to weather economic downturns and emerge stronger.

Factors affecting retained earnings

Several factors can impact a company's retained earnings, including economic conditions, industry trends, and company policies and strategies. For example, a company may choose to reinvest more of its earnings during a period of economic growth to take advantage of new opportunities. Alternatively, a company may choose to conserve its retained earnings during an economic downturn to maintain stability.

What is retained earnings' affection?

How to improve retained earnings

There are several strategies that companies can use to improve their retained earnings. By implementing the following strategies, a company can improve its retained earnings and ultimately build a stronger financial position.

Increase revenue and Reduce expenses

One of the simplest ways to increase retained earnings is to increase revenue. A company can achieve this by expanding its customer base, offering new products or services, or increasing its prices.

Reducing expenses is an important strategy that companies can use to improve their retained earnings. By reducing expenses, a company can increase its profits and therefore its retained earnings. This can be achieved by cutting costs in areas such as advertising, rent, and labor.

Invest in growth

Investing in growth initiatives such as research and development, marketing, and new equipment can help a company generate more revenue and profits in the long run, thereby improving retained earnings.

Invest in growth to improve retained earnings

Maintain good debt and financial management

Managing debt is crucial for improving retained earnings. A company should aim to reduce its debt as much as possible, as high levels of debt can eat into profits and reduce retained earnings.

A company should have a sound financial management system in place to ensure that it is making the best use of its resources. This includes monitoring cash flow, maintaining accurate financial records, and making informed decisions based on financial data.

Retained earnings are a critical aspect of a company's financial performance. Hopefully, through this article of Viindoo, you have the answer to the question “what is retained earnings". By carefully managing and utilizing retained earnings, companies can build a strong foundation for long-term success.

Replies to This Discussion