1. What is WACC?

WACC (Weighted average cost of capital) is defined as the weighted average cost of capital. This index is used to calculate the average cost of capital based on the ratio of existing capital types in the business.

WACC is usually calculated as a %. This metric represents the minimum amount of profit a business must earn in the course of its operations to satisfy its creditors, owners or investors. This index cannot be determined by factors inside the business but from the external market. This is an important indicator that investors are interested in when they want to invest in a certain business.

In general, the higher the weighted average cost of capital, the higher the risk of investing in the company. For example, if a company has a WACC of 5%, that means for every Dollar of funding (through debt or equity), the company needs to pay $0.05.

What is WACC?

What is WACC?2. What is WACC used for? Meaning of WACC

Most businesses today operate with many different sources of capital, in which loans account for a large proportion. Therefore, the WACC index is of great interest to be able to assess the potential of a business. Under normal conditions, a business with a low WACC is considered to attract investors at a lower cost.

In the field of corporate finance, the WACC index plays an important role. The reason is that WACC measures a company's cost of capital, which is the most important factor for any organization. This index is equally important to assess the potential of an upcoming investment project or merger or acquisition of other businesses.

3. How to calculate WACC correctly

Businesses often have to use different forms of funding to meet the financial requirements of a particular project. However, each type of capital has a different cost. That's why any business needs a weighted average cost.

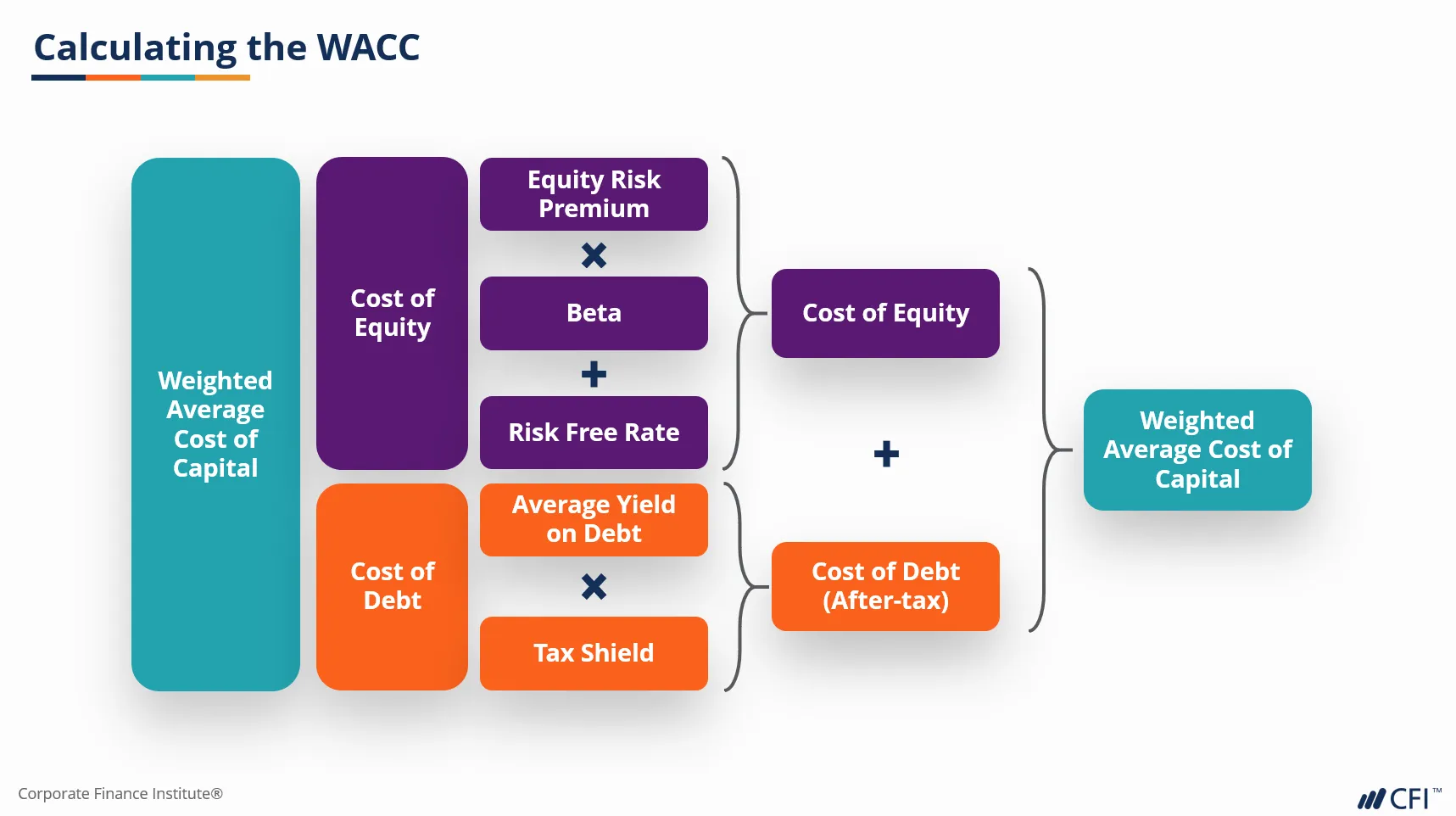

How to calculate WACC (Source: Internet)

How to calculate WACC (Source: Internet)The weighted average cost (WACC) is calculated using the formula:

In there:

- K E is the cost of equity capital.

- K D is the cost of debt.

- E: The market value of equity.

- D: The market value of debt.

- V (E + D): is the total long-term capital in the enterprise..

Refer to the following example to better understand how to calculate WACC:

A joint stock enterprise has a total capital of $6000 including two sources of capital, debt and equity. In which, the value of the loan is $2400, accounting for 40%. Equity is valued at $3600, representing 60%. The capital structure is said to be optimal.

Assume that the company's pre-tax cost of debt capital is 10% per year. The cost of equity is 14.3%/year. The corporate income tax rate is 25%/year.

Then we can calculate the weighted average cost of capital (WACC) = 60%*14.3% + 40% * 10%* (1-25%) = 11.58%.

4. How much WACC is good?

First, the WACC index in different industries is different. For example, small companies, startups often have a higher WACC because of more risk. This is the opposite at large, stable companies. In general, a lower WACC represents a business with a high level of safety and less risk.

Determining whether the WACC is good or bad depends on the industry in which the business operates. For example, heavy industries, such as oil, have to operate with huge amounts of capital, which will require a lot of borrowing and lead to an increase in the WACC index. Small businesses also tend to do this because they need a lot of debt to grow the business.

The formula for calculating the weighted average cost is based on the balance between the cost of debt and equity. Therefore, there is no single best WACC level. A low WACC can be seen as a stable company with low cost of borrowing. However, this is not necessarily a good thing in all cases as it can show that the company is being too dependent on external loans and is not in balance with equity.

Replies to This Discussion